Enterprise Risk Management: What Every Business Leader Needs to Know

When things are going well for a company, it’s hard to fathom them going wrong. But leaders always need to prepare for worst-case scenarios. Weaving enterprise risk management into your overall business plan is an essential part of running a successful company.

Learn how to develop an operations management strategy that helps you realize your maximum potential.

According to the Institute of Internal Auditors, “Risk is the possibility of an event occurring that will have an impact on the achievement of objectives. Risk is measured in terms of impact and likelihood.”

Enterprise risk management (ERM) is knowing what those risks are and understanding how to monitor and mitigate them to minimize their impact and protect your company.

Conducting business carries inherent risks. They might originate externally, like the current COVID-19 crisis or a cyberattack. Risk can also materialize internally, like a personnel lawsuit. But one recent study showed that only 3% of companies have a robust risk management process in place.

Risk and running a business go hand in hand. Learning to take calculated risks is a desirable leadership quality. Being risk averse can hinder growth. Leveraging risks can give your company a competitive advantage and deliver real results—like greater market share and bigger profits.

In this complex relationship, leaders need to control their business outcomes by creating an enterprise risk management framework.

What Is Enterprise Risk Management?

Just like insurance protects physical assets against the threat of destruction, enterprise risk management protects a company’s digital assets, workflows, and operations from massive disruption. It assesses the risks that could derail a company from achieving its objectives.

Companies can face any number of risks that can impact them in different ways. Professor David F. Larcker at Stanford University’s Graduate School of Business states that risk management is asking, “What can go wrong?”

Here are some areas of an organization that could be susceptible to risk:

- Legal

- Financial

- Personnel

- Operational

- Compliance

- Reputation

Enterprise risk management identifies, assesses, monitors, and mitigates key risk indicators.

ERM is a constant cyclical process. It surveys the landscape for known risks as well as prepares for unseen, sudden developments that can interrupt operations.

- Identify: A risk management process actively identifies known risks and threats that could potentially disrupt your operations. It remains vigilant regarding the possibility of unknown risks.

- Assess: A risk management framework assesses the level of threat each risk presents, which part of your organization it will impact, and calculates the potential loss. This phase also determines the likelihood that the risk will impact your company and your risk threshold.

- Monitor: It’s important to keep your eye on surrounding risks as you move towards your business objectives. Internal audits can help find and resolve areas of risk exposure susceptible to financial loss.

- Mitigate: When a risk threatens your organization, a mitigation plan that’s built into your framework will guide your response to lessen the severity of its impact, such as the financial loss or time your company is forced to be offline.

Pro tip: An internal audit is a great way to fully realize risks and the best response plan for your business.

Why is Enterprise Risk Management Important?

Enterprise risk management is a proactive business practice that protects a company from external or internal events that can paralyze operations.

ERM should be more than a go-to playbook for how to make big business decisions. Assessing risks should be a guiding principle for your day-to-day workflows and built into your company’s standard operating procedures. Mitigating risk can be done through policies, procedures, or tools using technology and software.

Here is why enterprise risk management should be woven into the fabric of any company’s business strategy:

- Identification of risks and threats can help your company mitigate their impact or avoid them altogether.

- Risk awareness empowers a company to make well-informed decisions that have great returns.

- Familiarity with up-to-the-minute regulatory risks gives you information to select the right technology to stay in compliance, like wage laws.

- Enterprise risk management is an organizational-wide strategy that engages every employee. This strengthens the organization as a whole and eliminates penetrable areas vulnerable to risks.

- Having an enterprise risk management framework creates a consistent approach to decision-making and risk-taking within a company.

- Creating and implementing an ERM leads to greater external confidence in your brand, from customers and investors.

The Key Differences Between Risk Mitigation and Risk Management

Risk mitigation and risk management are often confused. While they are connected, there are some key differences between the two:

Risk management is the entire lifecycle of identifying, monitoring, and mitigating risks. It includes all of the strategies, policies, and technology a company implements to navigate potential pitfalls that could negatively impact a company. A company might have a Chief Risk Officer (CRO) or designate internal leaders to lead the risk management charge.

Risk mitigation lives under the umbrella of risk management. It is the specific step in the life cycle that involves the process of lessening the impact if and when risk overwhelms a company.

Industry Spotlight: Risk Management in Manufacturing

Manufacturers have long navigated the threat of disruption. Some of the industry’s immediate risk factors that have the potential to negatively impact operations include:

- Labor shortage and skills gap

- Workplace safety

- Volatile relations with international trade partners

- Cybersecurity

As Industry 4.0, hailed as the Fourth Industrial Revolution, takes hold, technology is optimizing risk management throughout the industry.

Let’s take a look at one aspect of today’s manufacturing trends—predictive maintenance. This is the ability of AI to signal when equipment needs a mechanical check-up. Not only has predictive maintenance facilitated more efficient operations, it has become an integral part of manufacturing risk management frameworks by:

- Avoiding potential safety incidents by automating systems and removing the number of humans operating production lines. Manufacturing has long ranked third for workplace hazards with 400,000 job-related injuries a year.

- Reduces losses from planned downtime by only servicing equipment when it’s needed

- Reduces the risk of expensive, unplanned downtime due to equipment breakdowns

Equipment failure causes 42% of a factory’s unexpected downtime and costs companies $260,000 every hour.

But as technology reduces one type of risk in the manufacturing industry, it simultaneously creates another. As the Internet of Things has moved the control of manufacturing operations to cloud-based networks, companies must now include cybersecurity in their next generation of risk management framework. Thus, ERM in manufacturing must constantly be audited and analyzed to keep pace with the evolving industry and evolving risks.

Pro tip: In your enterprise risk management framework, calculate close-to-exact losses to realize the full impact they can have on your company.

Different Types of Organizational Risk

Here are four types of risk team leaders must be aware of and plan for:

- Enterprise-level risk: Risks that can possibly disrupt the asset capital of a company and its ability to operate.

- Compliance risk: Companies need to be constantly aware that business activities are compliant on several levels—meeting internally set risk barometers, industry-accepted standards, and enforceable regulatory standards, such as GDPR compliance.

- Operational risk: ORM is sometimes used to refer to the subset of risk management that deals with the safety aspects of a company, like in manufacturing. But in general, operational risk management encompasses any risk associated with the functions of a company.

- Project risk: These are risks associated with a specific project within an organization.

4 Top Tips When Creating a Risk Management Framework

Every crisis will have a unique impact on your company. To design a comprehensive risk management framework follow these four tips.

1. Be transparent with ERM.

While leadership should be in charge of risk management framework creation and oversight, it’s important to share your enterprise risk management plan with your entire staff. This creates a culture of risk awareness so every worker, no matter what level, is aligned on the company’s vision and on alert for risks or threats to those objectives.

Though reporting and tracking will happen at the senior and board levels, managers should also champion policies and procedures of risk strategy. In crisis situations, managers should have well-defined roles to help in the mitigation phase.

2. Leverage technology to mitigate risk.

Technology can help a company mitigate risk in several ways. It can collect internal data within your company to ensure compliance. It can even be used to automate processes to reduce the risk of human errors that could impact productions, safety, and operations.

Deloitte’s 11th Annual Global Risk Management Survey found that 68% of companies believe emerging technologies (cloud computing, AI, robotics, machine learning) will help reduce risks by automating functions and reducing errors.

3. Conduct crisis post-mortems

Despite every effort to monitor and mitigate risks, crisis is inevitable in business. The purpose of creating an enterprise risk management framework is to prepare for them. But when you are faced with an event, be sure to do a post-mortem.

Analyze:

- What happened

- What part of your company it penetrated

- The impact of the financial loss

- Where there were gaps in the response plan

Dissecting the event and your company’s reaction will help you revise your framework to be better prepared for the next incident.

4. Use digital tools with built-in compliance.

Internal communications technology can play a big role in your risk management process.

- Think of the retired military lookouts that surround the Golden Gate area of San Francisco. Perched on the edge of the Pacific, personnel once manned them, on the lookout for risks along the horizon. Workforce communication technology facilitates bottom-up communication so every employee, like essential frontline workers, can alert you to risks from their unique vantage point.

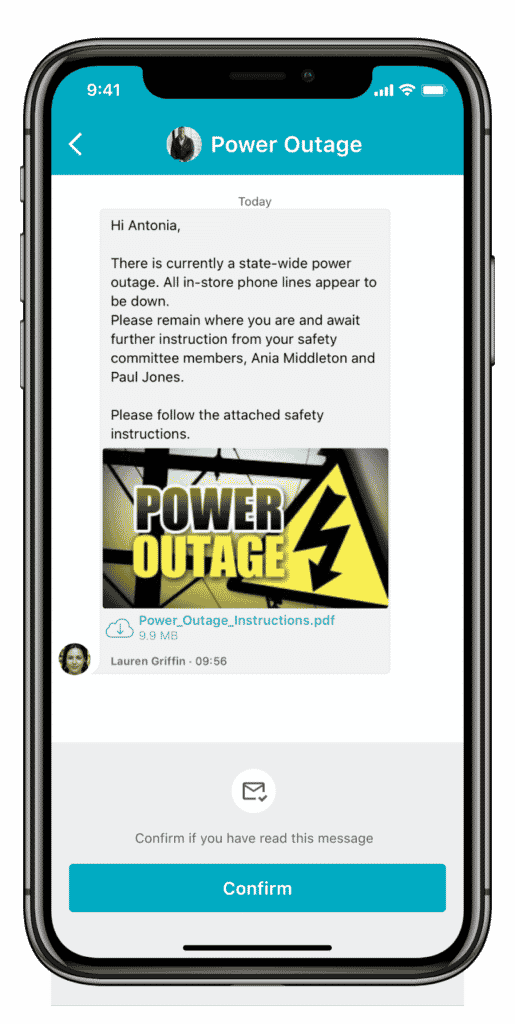

- The best digital tools are equipped with built-in risk management features. For example, Beekeeper enables managers to navigate employee compliance laws with a do-not-disturb mode which enables you to “reduce legal risk by automatically muting notifications for off-duty workers.”

- Use your mobile-first internal communications software to share and store your documentation for equal access to all employees.

Enterprise risk management requires a 360-view of your company. Make it comprehensive by including your entire team and building a framework that enables your company to reach its objectives with minimal loss.

To learn how an enterprise risk management framework can help your company assess and mitigate risks, download our crisis communication checklist now.

Most Frequently Asked Questions

Enterprise risk manager identifies, assesses, monitors, and mitigates key risk indicators.

About the author

Beekeeper

We make frontline lives easier, work safer, and teams more connected so businesses can reach new heights. At Beekeeper, we’re dedicated to making frontline lives easier by connecting workers with the tools, support, and information they need to feel valued, do their best work, and drive the business forward.

You might also be interested in

Interested in learning more?

Join 1200+ companies transforming frontline work with Beekeeper. Start your journey today to make every task easier, every team stronger, and every shift smoother.