Table of contents

- Why Open Enrollment Communication to Employees Matters

- When to Announce Open Enrollment?

- The 3 Best Open Enrollment Communication Templates

- 5 Tips for Boosting Open Enrollment Communication

- Open Enrollment Communication At a Glance

- 5 Most Frequently Asked Questions About Open Enrollment Communication

Looking to streamline open enrollment announcement communication? You’ve come to the right place!

The open enrollment period is a set window of time that employees have to enroll in benefits or make changes to their plans. Unless they have a qualifying life event, employees must select their plans for the year during this timeframe.

Given how complex the process can be, open enrollment can be stressful and overwhelming for management and employees alike. Fortunately, a solid open enrollment communication plan can help streamline the process and boost open enrollment participation.

When employees miss the deadline, it creates more administrative work and can cause confusion and hinder productivity. To prevent these issues, it’s important to get the highest open enrollment participation possible —and the key to success is effective benefits communication.

We’ll be looking more in-depth at how companies can prepare for the upcoming open enrollment period. You’ll also find open enrollment communication templates that you can copy/paste from this article to help you get started on creating your very own open enrollment toolkit.

Why Open Enrollment Communication to Employees Matters

Although open enrollment is critical, there are a few obstacles for employees that can hurt participation and cause them to miss the deadline.

Here are a few common reasons why employees miss their open enrollment deadlines:

- Confusing jargon

- Lack of communication from their company

- Poor understanding of the process

For frontline employees, open enrollment communication can be even more challenging. Workers who don’t have a company email address may not even receive the information they need to participate.

Employees care deeply about their benefits. A study by the American Institute of CPAs found that 80% of workers would choose a position with benefits over the same position that offered higher pay but no benefits.

Open enrollment communication matters because it enables employees to understand the process in a way that’s clear and accessible, which ultimately boosts participation.

When to Announce Open Enrollment?

The golden rule of any communications strategy – plan ahead. Employees need ample time to review educational materials and consult with family members in order to make informed decisions.

Pro tip: Don’t forget to allow enough time for management to submit enrollment changes to insurance providers and verify enrollment was successful.

The 3 Best Open Enrollment Communication Templates

What does open enrollment communication actually look like? If you’re looking for sample open enrollment communication to employees, we’ve got two enrollment forms you can use when initiating the conversation.

The first open enrollment template is ideal if your communication with employees happens via email. The second open enrollment template is better suited for mobile communication platforms. Feel free to mix and match parts of both templates to create your own custom open enrollment announcement.

Open Enrollment Email to Employees Template

Hi [employee name / team],

Welcome to the start of Open Enrollment! If you’re not sure what that means or what you need to do, don’t worry. We’ll walk you through essential steps and deadlines.

For [current year], we are maintaining [describe plan types] and have made the following changes: [describe plan changes].

This year’s enrollment period is [enrollment period dates]. This is the only period of time during the year when you can make changes to your benefits. Note that even if you choose to waive coverage, you must still complete the Open Enrollment process.

Please follow these next steps to complete the Open Enrollment process by [deadline].

- Log into [employee benefits software] using your company email address

- Follow enrollment instructions

- Receive confirmation and logout

If you have any questions about the Open Enrollment process, please reply to this email or contact [email address].

Thank you,

Open Enrollment Letters to Employees Template for Mobile Platforms

First Day of Open Enrollment!

This year’s Open Enrollment period has officially started. This year’s period is [enrollment period dates]. During this time, you’ll be able to make changes to your benefits plan for [current year].

During the Open Enrollment process, you can:

- Elect your Flexible Spending Account (FSA) for your health care coverage

- Contribute to your Health Savings Account (HSA)

- Change your benefits beneficiaries and dependents

- Elect Long-term and Short-term Disability Insurance (LTD/STD)

- [other elements of enrollment process]

To get started, please click on [benefits software/section in platform].

For additional questions, please contact [name/email].

Communication Channels for Open Enrollment

How a company executes its open enrollment communication strategy is just as important as the information being delivered. Why? Because some communication channels are just more effective for open enrollment than others.

A 2020 report found that before the pandemic, the most common communication channels for open enrollment were:

- Email (79%)

- Internal websites (74%)

- On-site meetings (60%)

Other channels included mailing print materials and placing signs in the workplace.

But when 80% of the global workforce consists of non-desk employees, these communication channels simply aren’t effective. Non-desk employees on the frontlines often don’t have access to company email, and they certainly do not work in front of a computer all day. And considering that many frontline workers are distributed across different locations, on-site meetings and signage aren’t reliable means of communication either.

The best channels for open enrollment communication:

- Are traceable: Meaning they help employers track which employees have received information

- Are accessible to all employees, including non-desk workers

- Overcome language barriers

- Allow employees to ask questions

Adopting a mobile communication platform checks all of those boxes, especially since experts are predicting that mobile workers will be 60% of the total workforce by 2024.

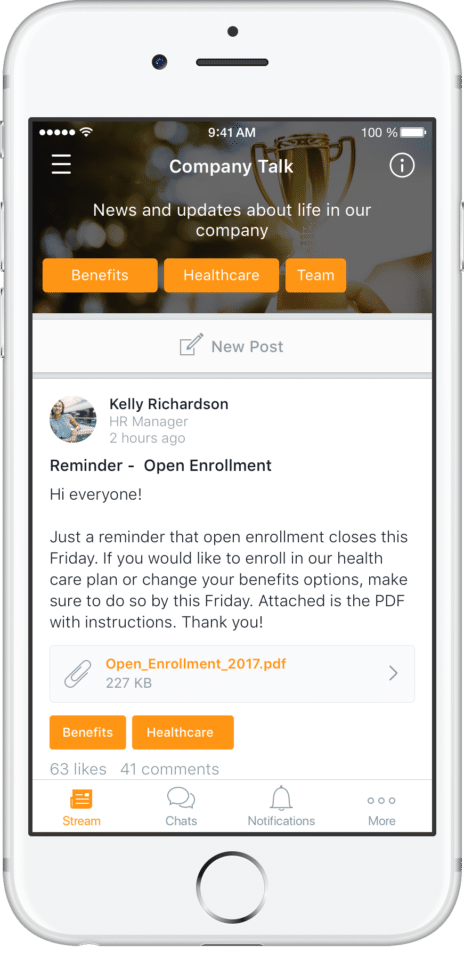

For frontline industries, a mobile platform like Beekeeper:

- Centralizes open enrollment communication

- Sends timely reminders about open enrollment forms

- Translates messages into each user’s preferred language

- Offers employee surveys to track the effectiveness of your open enrollment communication strategy

5 Tips for Boosting Open Enrollment Communication

Sending an open enrollment announcement is the first step.

Here are 5 more open enrollment tips to help create your open enrollment toolkit and make your open enrollment communication strategy successful.

1. Offer Open Enrollment Communication Education

“I completely understand my ever-changing healthcare benefits” is likely not something you’ll hear from any employee. Let’s be honest, healthcare and insurance can be very confusing! Because of this, employees frequently avoid making changes during the open enrollment window.

It’s an employer’s job to make sure employees have all the tools to make informed decisions by the deadline.

Plan and implement a benefits education program with offerings that suit your organization, such as:

- Seminars/webinars

- Personal consultations with experts

- One-on-one meetings with HR representatives

Ideally, you can repurpose these educational materials with minor tweaks as benefits change so you don’t have to reinvent the wheel twice a year.

Although it seems like more planning now, proper benefits education will save a lot of headaches down the road. These educational opportunities will demystify the process, make employees feel more confident in their decision-making, and boost open enrollment participation.

2. Initiate Open Enrollment Announcements about Potential Consequences

To get higher enrollment participation, employees need to understand what happens if they miss open enrollment. By communicating potential consequences, employees are more likely to take the deadline seriously. It’s not meant to be a scare tactic, it’s the reality of what could happen.

Potential consequences could include:

- Not receiving any benefits (if enrolling for the first time)

- Dependents being dropped or not added

- Lapses in coverage

All of these scenarios can have a significant financial impact on the employee.

In a nutshell, a company’s open enrollment communication strategy may be the only source of information employees receive, so it’s vital to arm them with plenty of information and support.

3. Use an Accessible Platform Designed for Open Enrollment Communication

We’ve discussed what to communicate, but what is the best distribution method? Email is widely used for benefits communication, even though it’s often ignored or doesn’t reach the entire workforce.

If employees aren’t using a computer, there’s a good chance they’re on their smartphones. Mobile communication and collaboration apps are a great way to reach your mobile team members with open enrollment information.

With a mobile employee app, you can:

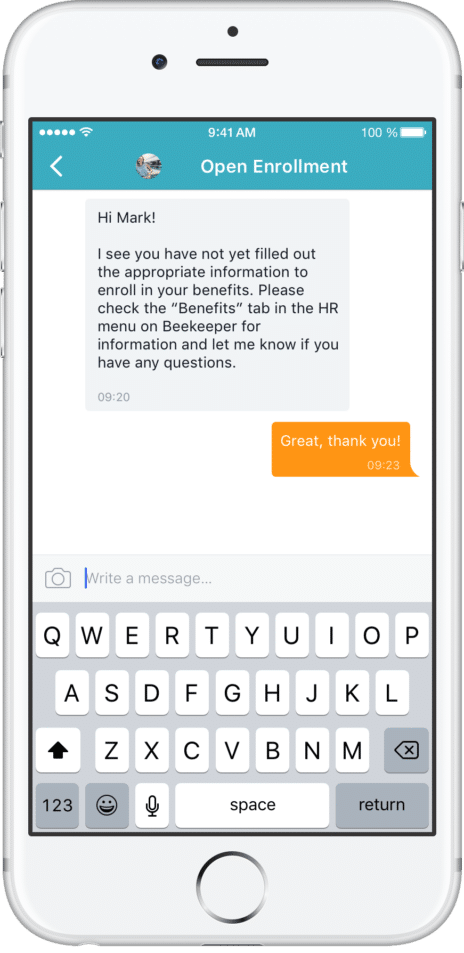

- Message your employees directly about benefits information

- Schedule automated enrollment reminders

- Send confirmation campaigns

- Automate workflows, to save time and energy

Is your benefits communication accessible to your non-desk employees? There are many more ways to improve employee benefits communication with a mobile workforce. For example, busy frontline employees will appreciate frequent open enrollment communication in bite-sized chunks they can read on the go.

4. Focus on Communication with Employees Who Don’t Open Benefits Messages

How can you boost participation numbers for Open Enrollment? Put extra effort into special communications channels and strategies to reach employees that continuously don’t open their benefits communication messages.

Often, the hardest part of the Open Enrollment process for employees is taking the first step. If employees don’t open the first few messages, they likely won’t see future reminders.

Employees might not be opening messages because they are intimidated by the Open Enrollment process and/or don’t know what it involves. One way to reach employees who aren’t opening messages about Open Enrollment is to send additional open enrollment resources to answer frequently asked questions such as:

- If I choose to waive coverage, do I still need to enroll?

- How can I find out my coverage and benefits?

- How can I change my healthcare plan and/or add dependents?

By reaching out to employees who are lagging behind in open enrollment participation, you can analyze your communication strategy and improve it for the future. For example, if employees aren’t opening messages because they’re not comfortable with the language being used, consider a delivery method that offers inline translation.

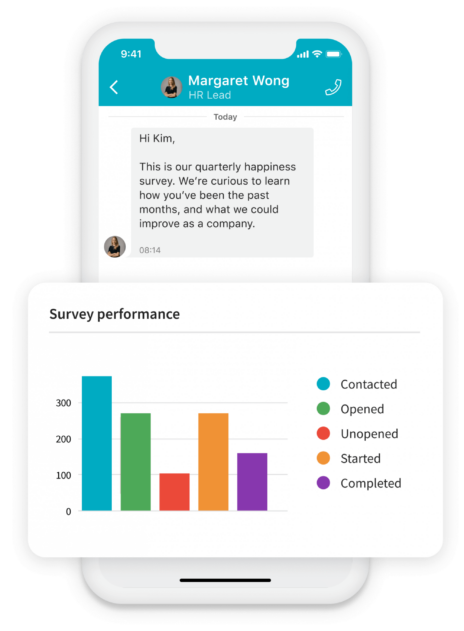

5. Ask for Feedback on Your Open Enrollment Communication Strategy

The best way to boost enrollment participation is to simply ask employees:

- What information do they want?

- How do they like to receive it?

- What will inspire them to take action?

They may prefer information being distributed in a different way than you’re providing. Or, they may have follow-up questions that can be addressed during feedback periods.

Employee surveys are a great way to clarify benefits options and the open enrollment process. And, with mobile employee communication apps, it has never been easier to get feedback directly from your essential mobile workforce.

Employee surveys demonstrate that you’re dedicated to making the process as convenient as possible, potentially reducing the number of employees that miss open enrollment.

Open Enrollment Communication At a Glance

At the end of the day, the goal of open enrollment communication is to enable employees to make informed decisions about their benefits. Here are a few additional Open Enrollment Tips for making that happen:

- Avoid jargon whenever possible or explain jargon with additional resources

- Remind employees that any changes to life circumstances may impact coverage choices

- Use visual as well as written methods for explaining open enrollment (charts, graphs, lists, etc.)

- Illustrate benefits choices and decisions with real-life examples

- Offer side-by-side comparisons between different plans

Although employees are responsible for managing their own benefits package, companies can go a long way in reducing confusion and boosting participation during the Open Enrollment period.

5 Most Frequently Asked Questions About Open Enrollment Communication

Open enrollment can be a complex and confusing process. If your employees come to you with one of these Open Enrollment Questions, we’ve got answers you can use to help them.

1. What is open enrollment and why is it important?

Open enrollment is the period of time during which individuals can enroll in or make changes to their health insurance coverage.

This period typically occurs once a year and is an essential opportunity for individuals to:

- Review their current coverage

- Assess their healthcare needs

- Make informed decisions about their insurance options

During open enrollment, individuals can choose to:

- Enroll in a new health insurance plan

- Make changes to their current plan

- Add or remove dependents from their coverage

- Switch between different plan options

- Review and update their personal information

Open enrollment is important because it provides individuals with the chance to ensure that they have the best possible healthcare coverage for their needs. It also allows them to take advantage of any changes or updates to healthcare laws and regulations that may affect their coverage.

Additionally, open enrollment is an opportunity for individuals to reassess their financial situation and determine how much they can afford to spend on healthcare. They can compare the costs and benefits of different plans, including premiums, deductibles, and copays, to determine which plan provides the best value for their needs and budget.

2. When does open enrollment typically take place?

Open enrollment typically takes place once a year during a specific period of time. The exact dates of open enrollment can vary depending on the type of insurance coverage and the state in which an individual resides. However, for most people, open enrollment for health insurance coverage typically occurs in the fall, usually between November and December.

For individuals who receive health insurance coverage through their employer, the open enrollment period generally takes place in the fall. Employees can review and update their coverage options, including health, dental, and vision insurance. They can also enroll or make changes to their flexible spending accounts (FSAs) or health savings accounts (HSAs).

It is important to note that missing the open enrollment period can result in limited or no options for making changes to your coverage until the next open enrollment period.

3. How do I access the open enrollment materials and information?

One of the first places to look for open enrollment materials and information is your employer’s HR department. Many employers provide their employees with detailed information about their coverage options, including brochures, videos, and other materials. Your HR representative can also answer any questions you may have about the enrollment process or your coverage options.

Another helpful resource for open enrollment materials and information is healthcare.gov, which provides information about health insurance coverage, including details about the open enrollment process. You can use it to compare different health insurance plans, estimate your costs, and find answers to frequently asked questions.

4. What documents or information do I need during open enrollment?

During open enrollment, you will need several important documents and pieces of information in order to make informed decisions about your health insurance coverage. Here are some of the key items you should have on hand:

- Current insurance policy information: This includes your policy number, coverage details, and any important documents related to your current coverage.

- Personal information: This includes your name, date of birth, Social Security number, and any other personal information required for enrollment.

- Income information: You will need to provide information about your income in order to determine if you qualify for any subsidies or tax credits. This may include your tax returns, pay stubs, or other income documentation.

- Health information: You will need to provide information about any pre-existing conditions, current medications, and any upcoming medical procedures or treatments.

- Family information: If you are enrolling family members in your health insurance plan, you will need their personal and health information as well.

- Plan options: It is important to have a clear understanding of the different health insurance plans available to you, including their benefits, costs, and coverage options.

5. Can I make changes to my benefit selections outside of the open enrollment period?

Typically, open enrollment is the only time of year when you can make changes to your benefit selections. However, there are some circumstances where you may be able to make changes outside of the open enrollment period.

One of the most common reasons for making changes outside of open enrollment is if you experience a qualifying life event. These events can include things like getting married or divorced, having a baby, or losing your job. In these cases, you may be able to make changes to your benefit selections to reflect your new circumstances.

Another reason you might be able to make changes outside of open enrollment is if you experience a significant change in your employment status. For example, if you switch from part-time to full-time employment, you may be eligible for different benefits than you had before.

In some cases, your employer may also offer a mid-year enrollment period, which allows you to make changes to your benefit selections outside of the open enrollment period. However, this is not common, and you should check with your employer to see if this is an option.

Download Ultimate Open Enrollment Communication Kit.

About the author

Beekeeper

We make frontline lives easier, work safer, and teams more connected so businesses can reach new heights. At Beekeeper, we’re dedicated to making frontline lives easier by connecting workers with the tools, support, and information they need to feel valued, do their best work, and drive the business forward.